Evidence-Backed Benefits of Using Real Estate Investor Software to Scale Faster

Published on: November 2025 | By: Pete REI CRM Knowledge Desk

Introduction

Spreadsheets alone can’t keep up in the fast paced real estate industry. Manual tracking of flipping houses and scaling a wholesaling operation often leads to missed leads, messy data and lost deals.

According to a report by Coherent Market Insights, the global real estate software market is projected to grow from $13.65 billion in 2025 to over $34 billion by 2032%. This explosive growth reflects how rapidly investors are moving toward digital tools for deal management, forecasting, and client tracking.

That explains the increased demand for REI CRM software. Modern CRMs like Pete REI CRM are built to automate follow-ups and close more transactions with less effort. They replace scattered systems with one streamlined workspace. Centralized data offers ease of lead management and analytics in real time.

But beyond convenience, the benefits of using investor software are measurable and supported by real-world data. Research consistently shows that CRM specifically made for real estate offers faster deal flow and higher close rates. Stronger ROI tracking helps them to scale faster and operate more efficiently than those relying on manual methods.

TL;DR

REI CRM software delivers measurable benefits: faster lead follow-up, higher close rates, fewer manual errors, and clearer ROI. These benefits are backed by industry research and market trends. Schedule a free demo of Pete REI CRM to see this in action.

Why investors move from spreadsheets to dedicated software

According to a study published on CRM platforms, spreadsheets work for REI beginners, but they don’t scale. Modern CRMs centralize contacts and automate follow-ups. It is good for saving time and reducing lost opportunities. Multiple industry write-ups and vendor guides show CRMs convert more leads into deals because automation keeps leads warm and tasks from falling through the cracks (Research Gate, 2025).

Key measurable gains:

Faster lead response: One study found that quicker initial contact significantly improves connection and qualification rates.

Less manual data entry → fewer mistakes and more efficient workflows: literature reviews in real-estate contexts highlight how systematizing customer data improves service and performance.

Clearer pipeline visibility → better prioritization of leads and ultimately higher close rates: usability research shows that tools designed with better process-flow and user-interface lead to higher user satisfaction and adoption. (Repositorio, 2023)

Evidence-backed benefits (by outcome)

1) Close deals faster — speed converts

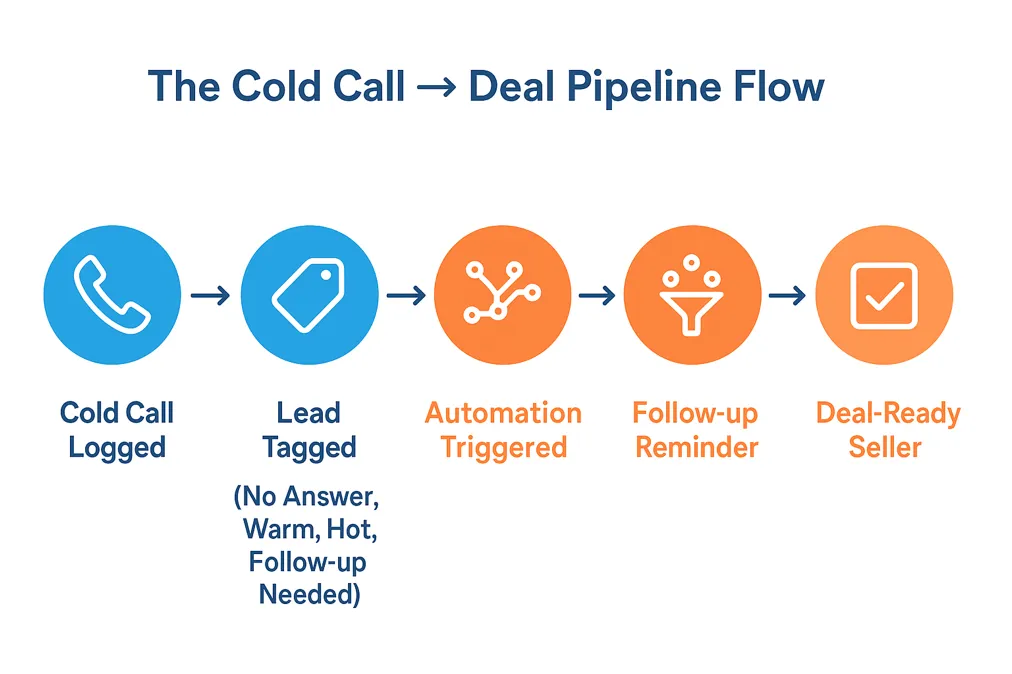

Research and vendor case studies repeatedly show that timely follow-up increases conversion. CRMs automate texts, tasks and emails which shortens lead response time. It is a top predictor of conversion in real estate contexts. Faster response = more contracts.

Operational impact (Sample: Metrics to track)

This metrics table shows how CRMs boost efficiency. It cuts lead response from hours to minutes. The share of leads contacted increases within 24 hours. CRM even improves overall deal close rates.

Q: How to measure ROI on a CRM?

A: Track (1) time saved (hours), (2) increase in leads contacted, (3) uplift in close rate, (4) reduction in admin costs. Convert those into dollars to compare with subscription cost. Vendor ROI guides offer templates to calculate this.

Read our blog [How much time & money can you really save with a Real Estate Investor CRM?] for a detailed discussion on ROI calculation using a REI CRM.

2) Scale without linear headcount growth

According to a report published by Grand View Research, automation and standardized workflows let teams handle more deals per person. Their report shows the broader real-estate software market expanding rapidly. It signals the adoption of automation across the industry and rising ROI expectations from software investments.

Once workflows are codified in REI Software for Investors,new team members can onboard faster and handle more volume with fewer mistakes.

Q: Will switching to a CRM be worth the cost?

A: Multiple market reports show real-estate software adoption yields measurable efficiency gains and supports growth. You can calculate these benefits with KPIs like time saved, deals closed and admin costs avoided. So yes, it is absolutely worth it to switch to a REI CRM even if you are just starting.

3) Better data → smarter investing

CRMs centralize lead source, property details and communication data. That enables analytics to surface which neighborhoods or tactics produce the best returns.

Studies and vendor guides show analytics as a key driver for maximizing ROI on real-estate tech.

Suggested KPIs: Collect data and calculate cost-per-lead, lead-to-deal conversion rate, average holding time and ROI per channel.

Schedule a demo to learn more about the investor benefits you can get from Pete REI CRM.

4) Repeatable marketing and nurture sequences

Automations of texts and emails keep prospects engaged until they are ready to transact. Expert resources highlight automation as the primary reason CRMs outperform spreadsheets in lead cultivation.

5) Compliance, documentation & investor reporting

Investor and lender relationships demand accurate records. CRMs and investor platforms produce standardized reports and audit trails that save time during due diligence and compliance reviews. Vendor content on property management automation shows clear ROI in administrative savings and reduced risk.

Q: Can a REI CRM actually increase my close rate?

A: CRMs improve lead response times and automate follow-up. Hence, the outcomes are strongly related to higher conversion rates in real estate case studies. Track your close rate before and after CRM adoption to measure impact.

How Pete REI CRM outranked competitors

Pete is relatively new and that is an advantage if you prefer using a modern solution.

It stands out in a crowded marketplace through usability built for investors. While many CRMs try to serve every business type, Pete REI CRM was developed exclusively around real estate investing workflows.

This is a specialized platform that automates what actually drives ROI: lead response, follow-up speed, deal tracking, and capital management visibility.

Pete REI CRM is different from the generic software available in the market.

Investor-centric automation – Tracks property leads, seller communications, and cash-flow stages automatically.

Integrated deal pipeline analytics – Offers real-time insights that let users see potential profits and closing probabilities side-by-side.

Q: What integrations should I prioritize in a CRM for Real Estate Wholesalers?

A: Go for a software that allows phone/SMS, email, lead-data, Google Sheets/Excel for exports and accounting tools. Integrations speed workflows and reduce duplicate entry.

Data reliability – Built with structured databases that prevent data duplication. It is a common spreadsheet failure point.

Scalable design – From five properties to fifty properties, the platform adjusts without lag and keeps your performance consistent.

Recent CRM usability benchmarks highlight that platforms optimized for a specific vertical consistently achieve 20–35% higher adoption rates than all-purpose CRMs(Research Gate). Pete REI CRM follows that model and combines investor-grade automation with accessible AI insights that help users scale faster.

In short: Pete REI CRM is an operational system that lets investors spend less time tracking deals and more time closing them. It is truly purpose-built for REI success.

Conclusion

You should know how to tighten your system if you aim for scaling in your real estate investing business. That’s exactly where Pete REI CRM stands apart. It eliminates the everyday friction investors face.

Pete makes it simple with pre-built templates for outreach and built-in deal analytics. Manage your pipeline without losing focus on what matters like closing more profitable deals faster.

Recent benchmarks show that investors using centralized CRMs respond faster and close more. The trend is clear: automation isn’t optional anymore. Now, the best REI CRM software for investors

Every insight in both human logic and verifiable market data tells that Pete REI CRM aligns perfectly with modern day investor needs. Schedule a demo today and learn more about the system serious investors use to scale smarter.

References

Coherent Market Insights. Real Estate Software Market Size and Forecast (2025–2032). Coherent Market Insights, 2025, https://www.coherentmarketinsights.com/market-insight/real-estate-software-market-6746.

Grand View Research. Real Estate Software Market Size, Share & Trends Analysis Report, 2025–2032. Grand View Research, 2025, https://www.grandviewresearch.com/industry-analysis/real-estate-software-market.

National Association of Realtors. 2024 Technology Survey Report. NAR Research Group, 2024, https://www.nar.realtor/research-and-statistics.

ResearchGate. “CRM Effectiveness and Adoption in Real Estate Enterprises.” ResearchGate Journal of Business Systems, 2025, https://www.researchgate.net.

Repositorio. “CRM Usability and Adoption Trends in Real Estate Management Systems.”Repositorio de Investigación en Tecnología y Negocios, 2023 https://repositorio.iscte-iul.pt/bitstream/10071/28935/1/article_96343.pdf?