How Do Serious Investors Use CRM Dashboards to Spot Underperforming Properties?

As real estate investors, your work does not stop at just acquiring properties. You need to know which ones are working hard for your portfolio and which ones are quietly draining resources. Serious investors have stopped relying on spreadsheets and scattered tools. These applications can’t keep up with dozens of properties and multiple active deals. You need a purpose-built real estate wholesale CRM like Pete REI.

Pete REI differs from generic CRMs because it is designed only for investors. It doesn’t force you to customize generic sales pipelines. Instead, it gives you property-specific tracking and ROI visibility. This all in one affordable platform helps you scale as your portfolio grows.

TL;DR: Serious real estate investors steer clear of spreadsheets. They don’t see the point in investing in expensive generic CRMs. They use purpose-built tools like Pete REI to spot underperforming properties fast. Pete REI offers property-specific dashboards and automated ROI tracking which lets you catch hidden costs and manage deals efficiently. Pete REI is built for scalability and saving time. Schedule a 60-minute demo on how to spot underperforming properties before they drain your returns.

Why do serious investors care about underperforming properties?

Every investor has dealt with a property that looks good on paper but bleeds money in reality. Maybe the maintenance costs are rising or there is a bad ARV estimate. Whatever the reason, the real challenge is spotting those red flags early.

A CRM for real estate wholesalers helps you do this efficiently. You get:

• Automated performance alerts for vacancy, rent delays and ROI drops.

• Deal pipeline visibility from acquisition to exit.

• Centralized reports, so you don’t have to build from scratch.

Image 1: Spotting ROI Leaks: Snapshots of Traditional Spreadsheets Vs. Pete REI Dashboard

Q: Why is spotting underperforming properties so important?

Because one underperforming asset can offset the gains of two profitable ones. Investors protect their portfolio health by tracking ROI, cash flow, and occupancy at the dashboard level.

What Metrics Do Investors Track on Pete REI CRM Dashboards?

Generic CRMs will show tasks, emails, and basic deal stages. But serious investors want numbers that matter to properties and not sales leads. Pete REI is a CRM for wholesale real estate where you get property-centric dashboards that surface the following key metrics:

Q: Can investors customize dashboards in Pete REI?

You can filter by property, deal stage, ROI %, or lender. Applications like Resimpli often require workarounds but Pete REI dashboards are better. These are built with investors in mind where no extra setup is needed.

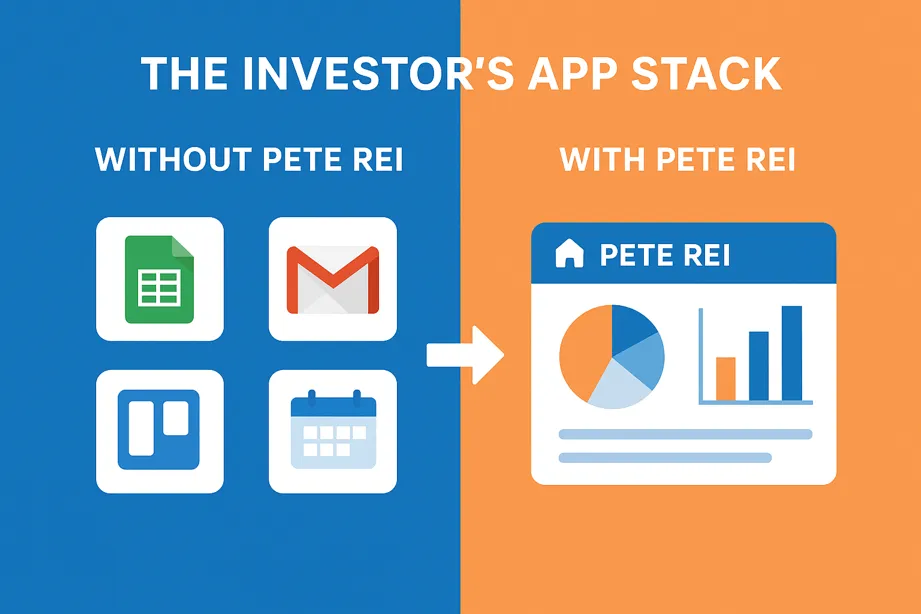

How do CRMs replace spreadsheets and multiple apps?

Spreadsheets may work when you have 2–3 properties. But manual entry turns into a liability once your portfolio scales. Forgetting one rent expense or missing one late tenant payment throws off projections.

Pete REI CRM replace the following tools from your work:

Spreadsheets → Automated ROI tracking

Email tools → Direct communication inside the CRM

Calendars → Built-in reminders and follow-ups

Task apps → Deal pipeline tasks pre-loaded for real estate

Image 2: Simplify your App Stack with only one application: Pete REI

Ready to stop underperforming properties faster? Book a free demo with Pete REI CRM today.

How do investor focused CRMs help manage private lenders and partners?

Serious investors manage relationships. One missed update or unclear ROI reports can damage credibility.

Pete REI dashboards solve this by tagging lenders by property/project. You can send automated deal updates and create lender-specific ROI reports.

Pete REI increases your management efficiency by keeping communication inside the CRM, which means no lost emails.

Example: Stop manually drafting monthly ROI emails. Choose Pete REI which auto-pulls data from the dashboard and sends clean reports to lenders.

What are the best ways to maintain long-term investor relationships?

We have a detailed blog that covers this topic and shares practical tips to help you build lasting investor connections. Check this blog here: [Can a Real Estate Wholesale CRM Help Investors Close More Deals?]

Q: How does Pete REI help with investor credibility?

Pete REI automates reporting and keeps all communication in one place. Serious investors know credibility = capital and Pete REI does that with effortless scalability.

How do investor CRMs highlight the “hidden costs” of properties?

Underperforming properties don’t always scream losses. Sometimes the issues hide in small leaks:

Investors often struggle with the higher than average fees of property managers, creeping utility costs or repeated contractor bills.

Spreadsheets bury these costs. Dashboards reveal them instantly with expense trend graphs and year-over-year comparisons. You may even set alerts when costs exceed preset limits.

Image 3: Efficiently compare expense growth for Property A and Property B with Pete REI Insights

Are you also stuck with hidden costs eating your profits? Schedule your free demo today and see Pete REI CRM in action.

Why is Pete REI better than Resimpli for spotting underperforming properties?

Resimpli positions itself as an all-in-one tool, but it is still closer to a generic CRM. Investors using Resimpli often complain about limited customization and confusing pipelines.

Pete REI has investor-first features that make it stand out. Below is a comparison table for you to understand better.

🔗 Related Reading: Customizable pipelines put Pete REI investor CRM ahead of the competition

Q: Why pick Pete REI over Resimpli?

Because Pete REI is purpose-built for investors. Resimpli requires workarounds, while Pete REI gives ROI tracking and property dashboards out of the box.

Conclusion

Serious investors don’t wait for year-end to find out which properties failed. They track in real time with the best CRM for real estate wholesalers which surfaces the truth. They invest in Pete REI CRM which gives them affordable scalability.

Stop flying blind and spot underperforming properties before they drag your portfolio down. Schedule your personalized free demo with Pete REI CRM now.

FAQs

Q1: How often should I check my CRM dashboard for underperforming properties?

Serious investors check dashboards weekly, not yearly. Pete REI CRM updates automatically, so a quick scan shows you ROI trends and cash flow changes without manual reporting.

Q2: Can Pete REI CRM work if I only have a few properties?

The system is scalable so even if you manage just 2–3 rentals, you will benefit from automated ROI tracking and deal pipelines. Pete REI grows with you without price shock.

Q3: What happens if I ignore underperforming properties?

They drain capital and slow portfolio growth. One property losing money monthly can cancel the profits from two successful ones. Pete REI dashboards help investors act quickly when renegotiating terms or selling.

Q4: How do real estate CRMs help with partner communication?

With Pete REI CRM you don’t have to manually create investor updates. It automates clear ROI and performance reports. This keeps partners engaged and boosts investor credibility.

Q5: Is Pete REI better for single-family or multi-family investors?

Both. The dashboard adapts to any property type, such as single-family homes, multi-family units, or even commercial assets. Each property gets its own performance tracking.

Q6: What makes Pete REI affordable compared to other CRMs?

Many CRMs charge per seat or per feature. Pete REI pricing is built for investors, with affordability and scalability baked in. That means you can grow your portfolio without multiplying your costs.